iTrustCapital Login: The #1 Crypto IRA Retirement Platform

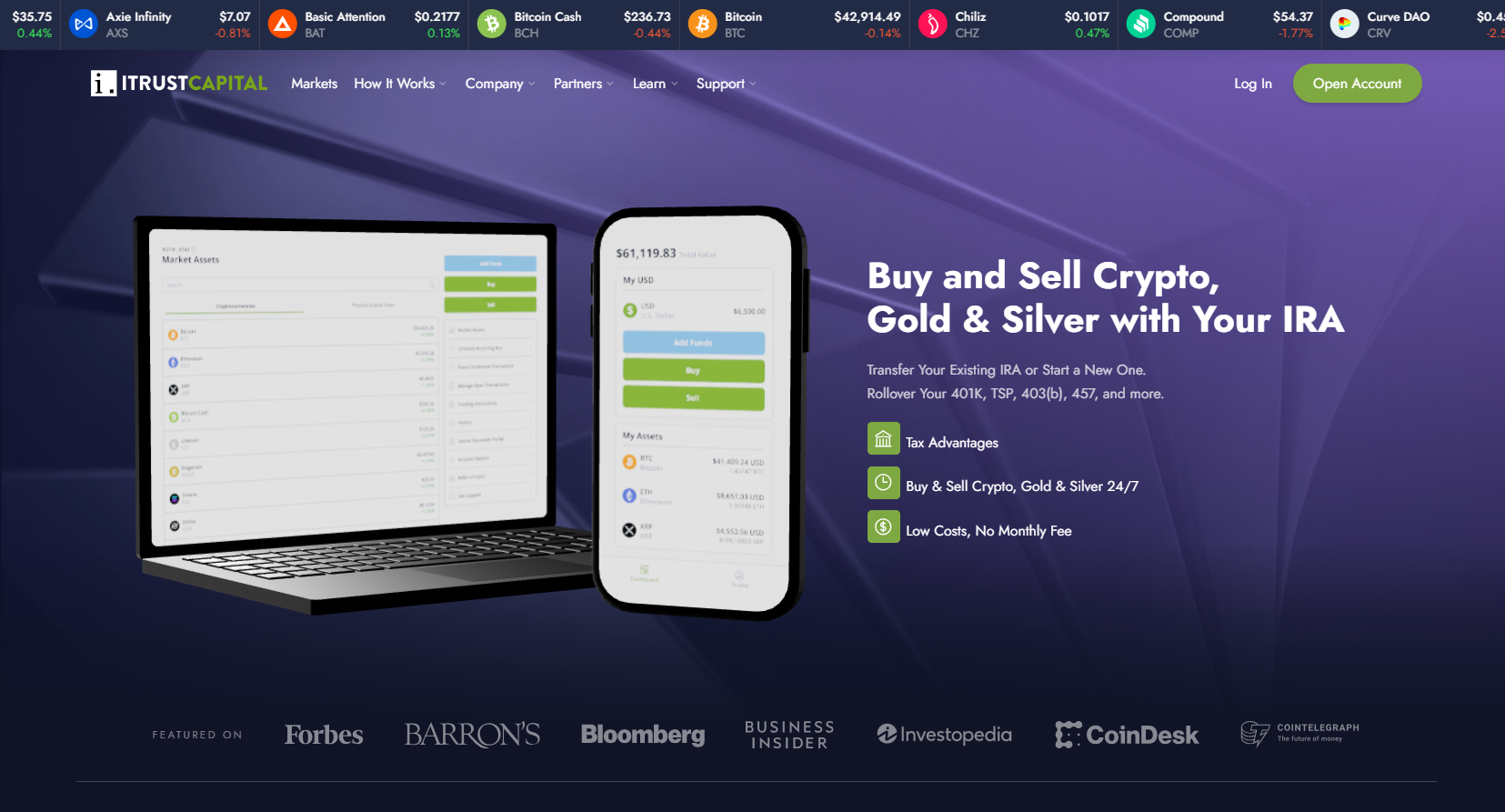

In an era marked by digital innovation and financial evolution, the landscape of retirement planning has undergone a significant transformation. Traditional investment avenues have expanded to include cryptocurrencies, and with them, a new breed of retirement platforms has emerged. Among these, iTrustCapital stands out as a pioneering force, offering individuals the opportunity to incorporate digital assets into their retirement portfolios seamlessly. This article delves into the world of iTrustCapital, exploring its features, benefits, and the process of iTrustCapital login, positioning it as the premier choice for Crypto IRA retirement planning.

Introduction to iTrustCapital:

iTrustCapital is a leading fintech company that facilitates cryptocurrency investments within Individual Retirement Accounts (IRAs) and 401(k) plans. Founded in 2018, iTrustCapital has rapidly gained prominence as a trusted platform for investors seeking to diversify their retirement portfolios with digital assets. The platform’s mission revolves around democratizing access to alternative investments, particularly cryptocurrencies, by providing a user-friendly interface and robust security measures.

Features and Benefits:

- Diverse Asset Offerings: iTrustCapital offers a comprehensive range of digital assets, including Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Ripple (XRP), and many more. This diverse selection enables investors to tailor their portfolios according to their risk tolerance and investment objectives.

- Tax-Advantaged Accounts: One of the key advantages of iTrustCapital is its compatibility with tax-advantaged retirement accounts, such as Traditional IRAs, Roth IRAs, and SEP IRAs. By investing in cryptocurrencies through these accounts, investors can enjoy potential tax benefits, including tax-deferred growth or tax-free withdrawals, depending on the account type.

- Secure Storage: iTrustCapital prioritizes the security of investors’ assets through institutional-grade custody solutions. Utilizing industry-leading security protocols and cold storage mechanisms, iTrustCapital ensures that clients’ digital assets are safeguarded against cyber threats and unauthorized access.

- 24/7 Trading: Unlike traditional financial markets, the cryptocurrency market operates around the clock. iTrustCapital acknowledges this reality by providing 24/7 trading capabilities, allowing investors to execute trades and manage their portfolios at any time, day or night.

- Transparent Fee Structure: iTrustCapital maintains a transparent fee structure, with no hidden charges or commissions. Instead, investors pay a flat monthly fee, which covers custody, trading, and account maintenance services. This simplicity and transparency empower investors to make informed decisions without worrying about hidden costs.

- Educational Resources: Recognizing the importance of investor education, iTrustCapital offers a wealth of educational resources, including articles, tutorials, and webinars. These resources serve to empower investors with the knowledge and insights necessary to navigate the complexities of cryptocurrency investing confidently.

iTrustCapital Login Process:

Accessing iTrustCapital’s platform is a straightforward process that begins with creating an account. Here’s a step-by-step guide to the iTrustCapital login process:

- Visit the iTrustCapital Website: Start by navigating to the official iTrustCapital website using your preferred web browser.

- Sign Up: If you’re a new user, click on the “Sign Up” or “Get Started” button to initiate the registration process. You’ll be prompted to provide basic information, such as your name, email address, and password.

- Verify Your Email: After completing the registration form, check your email inbox for a verification message from iTrustCapital. Click on the verification link to confirm your email address and activate your account.

- Complete KYC Verification: As part of the onboarding process, iTrustCapital requires users to undergo Know Your Customer (KYC) verification. This typically involves providing a government-issued ID (such as a driver’s license or passport) and proof of address.

- Fund Your Account: Once your account is verified, you can proceed to fund it using fiat currency or cryptocurrency. iTrustCapital supports various funding methods, including bank transfers, wire transfers, and cryptocurrency deposits.

- Choose Your Investment Strategy: With funds in your account, you can now explore iTrustCapital’s range of investment options and select the cryptocurrencies you wish to include in your portfolio. Consider factors such as risk tolerance, investment horizon, and diversification goals when crafting your investment strategy.

- Execute Trades: After finalizing your investment decisions, you can execute trades directly through the iTrustCapital platform. Whether you’re buying, selling, or rebalancing your portfolio, iTrustCapital provides a user-friendly interface that makes the process intuitive and efficient.

- Monitor Your Portfolio: Once trades are executed, you can monitor the performance of your portfolio in real-time. iTrustCapital offers comprehensive portfolio tracking tools, allowing you to track asset values, monitor market trends, and assess the overall health of your retirement investments.

- Secure Access: To access your iTrustCapital account in the future, simply visit the iTrustCapital website and click on the “Login” button. Enter your registered email address and password to log in securely.

Conclusion:

In conclusion, iTrustCapital represents a groundbreaking solution for individuals seeking to incorporate cryptocurrencies into their retirement portfolios. With its diverse asset offerings, tax-advantaged accounts, secure storage solutions, and user-friendly interface, iTrustCapital has established itself as the premier platform for Crypto IRA retirement planning. By leveraging the power of blockchain technology and embracing innovation, iTrustCapital empowers investors to seize the opportunities presented by the digital asset revolution while safeguarding their long-term financial security.